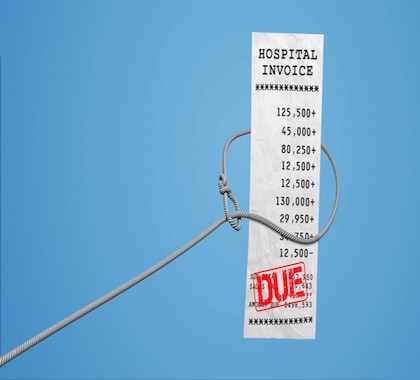

The Protecting Patients from Surprise Medical Bills Act (PPSMBA) would regulate three areas of health care expenses: emergency services provided by an out-of-network provider in an out-of-network facility, nonemergency services following an emergency service from an out-of-network facility, and nonemergency services performed by an out-of-network provider at an in- network facility.

Balance Billing in Crosshairs

The bill, sponsored by Sen. Bill Cassidy (R-LA), would require health insurers to pay the difference between a patient’s in-network co-pay and what the bill defines as a reasonable charge: 125 percent of the average allowed amount for insurers in the same region or the median cost of the service in states without balance-billing laws.

Balance billing occurs when a health care provider bills a patient for the difference between the amount the provider charges and what the patient’s insurance pays. In-network providers agree to accept the insurer’s price, but out-of-network providers do not have to do so, and they can bill patients for the balance.

More Government Intrusion

Justin Haskins, executive editor and a research fellow at The Heartland Institute, which publishes Health Care News, says although balance billing can be a burden on consumers, the answer is never more government intrusion into the market.

“It is noble to want to try to alleviate some of the pain associated with balance billing,” Haskins said. “But crafting more legislation at the federal level is never the way to go about it. Giving people more choice about the health insurance they want to buy and allowing the sale of affordable catastrophic health insurance plans to cover emergency needs would be a better option.”

Media Buildup

Benedic Ippolito, a research fellow at the American Enterprise Institute, says media attention to balance billing is behind much of the current concern about the practice.

“Balance billing isn’t a new phenomenon, but it’s only fairly recently vaulted into the public discourse in a major way,” Ippolito said. “In part, this is surely due to a raft of recent exposés from outlets like Kaiser Health News and Vox. Moreover, as insurers increasingly try to use narrower networks to control health care costs, there is reason to worry that this kind of out-of- network surprise billing could become more common.”

Top of the List

A poll conducted by the Kaiser Family Foundation found unexpected medical bills are individuals’ biggest health care and financial concern.

“When given a list of possible worries, unexpected medical bills tops the list that includes other health care costs such as premiums, deductibles and even drug costs, as well as other household expenses,” the poll report stated. “Four in ten insured adults ages 18-64 say there has been a time in the past 12 months when they received an unexpected medical bill and one in ten say they received a ‘surprise’ medical bill from an out-of-network provider in the past year.”

The poll, conducted in August 2018, calculated responses from a nationally representative, random telephone sample of 1,201 adults ages 18 years old and older, with an error rate of +/- 3 percentage points.

INTERNET INFO:

Ashley Kirzinger, Bryan Wu, Cailey Muñana, and Mollyann Brodie, “Kaiser Health Tracking Poll—Late Summer 2018: The Election, Pre- Existing Conditions, and Surprises on Medical Bills,” Kaiser Family Foundation, September 5, 2018: https://bit.ly/2JZFCLV