A new report by the Thomas B. Fordham Institute details the prevalence of so-called “charter school deserts”—places where at least three contiguous census tracts display a poverty rate of at least 20 percent and in which there are no charters. Unfortunately, these charter school deserts are disproportionately located in high-poverty neighborhoods.

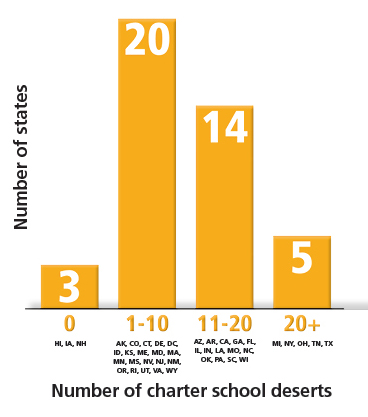

Currently, 41 states and the District of Columbia permit charter schools. However, only three of these states contain no charter school deserts. On average, states have 10.8 charter deserts—though a few states contain more than 20: Michigan, New York, Ohio, Tennessee, and Texas.

Historically, charter schools tend to exist in neighborhoods that are plagued by public schools that perform poorly. Data show charter schools attract higher percentages of black students and are located in metropolitan areas, underscoring the need for even more charter schools in low-income suburban and rural areas.

Far too often, states enact barriers and rules that prevent a robust environment for charter schools. Legislators should consider repealing regulations that make it difficult for charter schools to open and function. Furthermore, they ought to allocate public education funds to charter and public students at equal levels. Placing public and charter schools on an even playing field would create more competition and thus produce greater accountability and better academic outcomes for all students.

“For example, Illinois law limits the number of charter schools in the state to 120 and imposes a maximum of seventy-five charter schools in Chicago,” the authors wrote. “Rhode Island permits just thirty-five charter schools statewide, and Ohio mandates that charters open only in those school districts considered ‘challenged’ by the state. Such policies stifle the creation of schooling options in many places that need them.”

Since American students in public schools continue to perform poorly and lag far behind students in other countries in math and science, legislators should do everything they can to expand (not reduce) school choice options. In fact, a 2018 survey of likely voters conducted by the American Federation for Children shows nearly two-thirds of people favor school choice, with charter schools receiving more than 70 percent of support. Support is even stronger among African-Americans and Latinos.

In a new Research & Commentary, Heartland Policy Analyst Tim Benson concludes charter schools, vouchers, and education savings accounts are the best hope for many parents who desire that their children receive a high-quality education but are currently stuck in a failing school.

“While the policy solutions the authors put forward are all necessary and would be welcome, universal private school choice in the form of vouchers or education savings accounts would be preferable, as the gold-standard empirical evidence shows,” Benson wrote. “Still, charter schools should have their place. Nationally, they have provided a way out of failing traditional public schools for nearly three million children, and they provide competition for a bloated, sclerotic, unaccountable union-run public school system. This competition helps improve outcomes not just for the children who take advantage of school choice programs, but also for those who remain in their neighborhood public schools.”

Americans desire school choice, yet charter school deserts deny far too many parents the ability to quench their thirst to pursue the best educational option for their children.

What We’re Working On

Budget & Tax

States Get Creative and Potentially Destructive with ‘Cookie Nexus’

In this Research & Commentary, Heartland Senior Policy Analyst Matthew Glans examines the efforts by states to bypass legal precedent and impose sales taxes on internet purchases without a physical presence in the taxing state. “Instead of forcing out-of-state businesses to serve as government tax collectors, state legislators should implement a sales tax system based on where the product was sold, known as an origin-based tax system. This would encourage economic growth by bringing simplicity and certainty to the state sales tax quandary as well as truly leveling the playing field because online and brick-and-mortar retailers would pay the same tax,” Glans wrote.

Health Care

Trump Administration to Target Prescription Drug Prices

In this Health Care News article, Zachary Williams examines a new plan from the Trump administration would utilize Free to Choose Medicine principles to lower the cost of prescription drugs. Williams reported, “Those proposals, part of the American Patients First Plan, include four general pillars for helping to lower drug prices without instituting price controls: improved competition, better negotiation, incentives for lower list prices, and lowering out-of-pocket costs.”

Education

Protecting Students with Child Safety Accounts

In this Heartland Policy Brief, Vicki Alger, senior fellow at the Independent Women’s Forum and research fellow at the Independent Institute, and Heartland Policy Analyst Tim Benson detail the prevalence of bullying, harassment, and assault taking place in America’s public schools and the difficulties many parents face when trying to move their child from a school that is unsafe. Alger and Benson propose a Child Safety Account program, which would allow parents to immediately have their child transfer to a safe school—private, parochial, or public—as soon as parents feel the public school their child is currently attending is too dangerous to their child’s physical or emotional health.

Energy & Environment

How to Prevent the Premature Retirement of Coal-Fired Power Plants

In this Heartland Policy Study—the fourth in a series of four—Center of the American Experiment Policy Fellow Isaac Orr and Heartland Senior Fellow Fred Palmer offer a brief history of electric utilities and describe how efforts to deregulate them in the 1990s led to more, not fewer, regulation. They argue there is no “free market” in electricity today. They then describe the four Obama-era “zombie” regulations on coal and the six subsidies and mandates favoring renewable energy (primarily wind and solar) that must be eliminated to restore a true free market for energy.

From Our Free-Market Friends

Solutions for Austin’s Billion-Dollar Pension Crisis

James Quintero of the Texas Public Policy Foundation offers solutions to solve Austin’s financially insolvent pension retirement system. The City of Austin Employees’ Retirement System (COAERS) has promised $1.3 billion more in pensions than it has in assets, with a funding ratio of 64 percent. This assessment relies on an assumed rate of return of 7.5 percent, which is unrealistically high given historical trends. Using a lower return rate of 5.5 percent, the pension debt jumps to $2.4 billion. In response to the financial decline of COAERS, officials have increased employer and employee contribution rates, lowered the pension benefit multiplier, and tightened retirement eligibility. Unfortunately, there is still more to be done to relieve the pension crisis. Quintero suggests a few reforms, including creating a defined-contribution plan and a retirement-choice system and changing contribution rates based on actuarial determinations.

Click here to subscribe to The Leaflet, the weekly government relations e-newsletter.